I was just looking back at some analysis I've done of my spending and saving habits over the past couple of years. Ever since I moved into my condo, I've been griping on this blog about how much money I've been spending, but looking at these spreadsheets really brought it home for me:

2005:

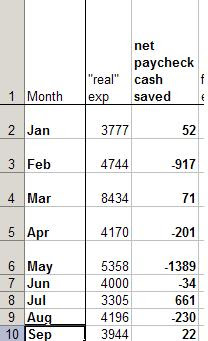

2007:

"Real exp[enses]" doesn't include taxes, deductions for health insurance, etc, or business expenses, but includes everything else. "Cash saved" is what is left after subtracting these real expenses from my net paycheck. The good news at least is that I continue to fund my 401k and Roth IRA accounts to the maximum allowed, and those 401k deductions are not included in the "cash saved" columns above. The bad news is that I adjusted my withholding this year, so I can't expect as big a refund at tax time to help me catch up.

"Real exp[enses]" doesn't include taxes, deductions for health insurance, etc, or business expenses, but includes everything else. "Cash saved" is what is left after subtracting these real expenses from my net paycheck. The good news at least is that I continue to fund my 401k and Roth IRA accounts to the maximum allowed, and those 401k deductions are not included in the "cash saved" columns above. The bad news is that I adjusted my withholding this year, so I can't expect as big a refund at tax time to help me catch up.Some other good news is that I won't continue to spend large amounts on home furnishings and that I'm running out of weddings to have to go to unless all my friends and family start getting divorced and remarried. I also got a raise, and hopefully I'll get a halfway decent bonus next year, as my bonus plan has been bumped up to a larger percentage of my salary.

Anyway, that is just the numbers. The other side of things is that I'm enjoying living in a nicer home, and I've been really busy, socializing more than usual, and generally having fun. That is a good thing, and it's what I'd like to use my money for, in some ways. The downside to it is that I can start to feel like I'm not home enough-- not getting enough use out of my new apartment, and not staying organized enough to keep groceries in the house for cooking meals or bringing lunches to work. I don't mind spending money to enjoy myself, but I hate feeling like I'm spending too much just because I'm too disorganized to stick to good habits.

I'm always trying to figure out how to manage life better. This blog covers my financial obsessions, but of course I'm equally over-analytical about a lot of off-topic stuff too, making lists and schedules and trying to figure out how I can squeeze all the things I want to do into one life. (Fortunately, sitting around staring into space is one of the things I always make time for-- I'm not as Type-A as I'm making it sound!) I know I need to be better about planning ahead so I can keep my food budget a bit more in check. But otherwise, I at least know that most of my expense categories are still under control and my income is growing. A good goal for 2008 will be to get back to saving as much cash per month as I did in 2005. Wish me luck!

3 comments:

It's a nice blog. Clean and to the point. I found it through Blogrush, they cleaned that up recently and now most of the listed sites are legit. That may be where a lot of your new visitors came from.

I don't know if your financial sphere includes options, but that's my specialty. My blog is contrarycanary.blogspot.com if you ever want to dip your toe in that alternate universe. Cheers.

Don't beat yourself up too much. Buying a new apartment, fixing it up, moving, and furnishing a bigger space are all very expensive activities. When you do your taxes this year you'll probably find the tax break on your mortgage makes up for some of the extra expense, and that tax break will continue for years. And now that you've settled in, and the early expenses are over, you will probably be able to get back to your saving ways. Just try to make sure you don't continue spending extra money -- once you start, it's easy to continue, and it's a habit that can be hard to break!

Could it also be that now that you've bought the apartment, you don't feel the same pressure to save every last penny for the downpayment and closing costs? Maybe that's partly why you've given yourself permission to spend more freely. You've worked so hard and saved for so long that you deserve some fun!

And like sandyvoice said, decorating and making it feel like "home" are expensive at first, but those expenses will taper off.

Post a Comment