So, how am I doing?

The green and brown lines are my two E*Trade portfolios, and the blue line is the Dow. So I guess the answer is "Could be worse." It has been on my to-do list to make some changes in these portfolios, but all I've done is buy $1,000 worth of Vanguard's NY Tax-Exempt Municipal Bond fund, which seemed like a relatively conservative kind of thing to put my money in...

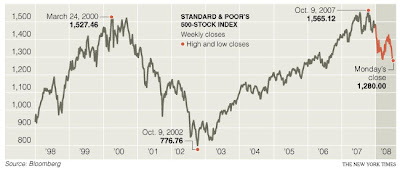

Other than that, I may just sit tight for a while. Obviously it's never a good time to sell when the markets are down, but if you think your money could do better somewhere else, it makes sense to move it. But "better somewhere else" is a tough question these days, since nothing seems to be performing all that well. Yesterday's NY Times business section had a graphic showing the rises and falls of the Dow over the past 10 years:

Ugly, isn't it?

Wednesday, July 02, 2008

Checking In On My Investments

Subscribe to:

Post Comments (Atom)

12 comments:

A quick observation of the second chart might suggest we have much further to fall.

The highs are very close, so will the lows be? If so, we have long way to go.

Hey Madame X, I've been thinking lately about experimenting with lending via prosper.com as a way to boost returns (or achieve any returns, period). I'm wondering if you've ever looked into prosper and what your opinion of it is...

many thanks!

Quick correction: The second chart is of the S&P 500, not the Dow.

Based on the current rates and your tax bracket, something like an ING Direct account (paying a taxable 3%) is a better play than Vanguard's NY Tax-Exempt Money Market fund (paying a tax-free 1.48%).

(Vanguard has no municipal bond fund--unless you mant the Long-Term Bond?)

I took a look at my 401k the other day and it made me sad because it's worth about 6% less than what I've put into it. Fortunately, I'm only 2 years into my career with a good 30+ to go, but it was still a little depressing.

Anon 12:29-- the fund I bought is VNYTX, which invests primarily in "municipal bonds issued by New York State and local governments."

And anon 11:13, yes, that is the S&P 500-- whoops!

Okay, that is the NY Long-Term muni bond fund.

Although it's better than a stock fund, it isn't really ideal for conservative money, since the share price can vary. (Check the history: it has ranged from $10.50 to $11.30 in the past year.) The share price of money market funds stay at $1, which preserves capital...but sacrifices yield in return.

But if you only want the income, then the 3.96% yield is pretty good.

One thing to note...When everyone is selling, it is a good time to buy. Markets have a tendancy to over-inflate and over-depress. Good buying opportunities will come out of this (but so will bankrupt companies too!)

i wish i could understand the stock market, but i don't so i don't buy any stocks but i only buy mutual funds.

On the graphs - you may want to compare with the S&P 500 rather than the Dow, as the S&P 500 is much more representative of a diversified mutual fund.

The Dow is dodgy - it depends on share price and comes from the days before calculators. So with only 30 companies and price rather than market cap based weightings, it isn't the best indicator.

Since you already have an Etrade account open an Etrade bank account that is paying 3.30%. It has a minimum to open of $1 and can be tied to your brokerage account.

BW

The charts describes the heights and lows of stocks and another way of investment is the internet business. I can suggest you to visit the site http://www.eCurrencyArbitrage.com for some interesting tips related to investment.

Post a Comment