Since I was feeling rather more flush with cash than usual, I decided to make an extra payment on my mortgage this month. It was so easy! I have it set up for electronic payment from my bank anyway, and if I send them an amount that doesn't match the monthly payment exactly to the penny, it's automatically taken as a payment against principal. It took about 5 seconds to send them $2,000.

There's always the debate as to whether it's better to hang onto the cash if you have a mortgage at a relatively low interest rate. Right now, I feel like interest rates are so low for savings that paying something off on my 5.85% mortgage is a very good investment. The other issue is liquidity, but I have enough cash on hand right now to cover my expenses for about a year, so I'm not too worried about shifting this $2,000 into equity I can't easily access right away.

Someone might argue that real estate values are going down and I'm just throwing good money after bad, but that's only true if I went into foreclosure and walked away from my condo-- otherwise, even if its value goes down, by paying off principal early, I have less of a mortgage balance to pay off, and will pay less interest over the life of the loan.

Another argument might be that I should put that money into the stock market-- it's been so battered lately that it may have potential for strong gains over the coming years. But I already put other money into the stock market. And who knows, the market could still go even lower. I don't want to have all my eggs in one basket-- even if paying off my mortgage could possibly be a lower rate of return, it's also much lower risk, so it's a good hedge against my other high-risk investing.

But really, the reason I want to pay off my mortgage early is so I can be like my idol, Frugal Zeitgeist!

Thursday, April 30, 2009

Extra Mortgage Payment

Posted at 8:48 AM 13 comments

Labels:

investing,

mortgage,

real estate,

saving

![]()

Wednesday, April 29, 2009

The Rich Are Still Rich

On the Wall Street Journal blog The Wealth Report, Robert Frank makes a good point:

There is a growing consensus that the rich have lost about a third of their wealth. First came the U.S. surveys, which show millionaires down about 30%–both in wealth and population–as a result of the global financial crisis. Over the weekend comes news that the Sunday Times Rich List shows that the crisis has wiped out about 155 billion pounds ($227 billion), or a third of the wealth of Britain’s 1,000 people. Sir Elton John, for instance, is down 26%.

So if we were to “reset” the world of wealth, we should just knock off about a third....

As Frank points out, wealth isn't the only thing that has declined: prices are going down. And much of what defines wealth is relative anyway.

I hope someone will tell this to some of the Wall Streeters profiled in this recent New York Magazine cover story:If your wealth has fallen 30%, and everyone else’s stayed the same, you would feel poorer. But if your wealth fell 30% along with everyone else’s, wouldn’t you still feel as wealthy as before?

And if the prices of things you buy also have fallen 30% or more, wouldn’t your experience of being wealthy stay the same?

It is accepted wisdom that a rising tide lifts all boats. Wouldn’t a sinking tide, when all boats are falling, still leave the yachts on top?

“I’m not giving to charity this year!” one hedge-fund analyst shouts into the phone, when I ask about Obama’s planned tax increases. “When people ask me for money, I tell them, ‘If you want me to give you money, send a letter to my senator asking for my taxes to be lowered.’ I feel so much less generous right now. If I have to adopt twenty poor families, I want a thank-you note and an update on their lives. At least Sally Struthers gives you an update.”Jerk.

Posted at 8:58 AM 13 comments

Tuesday, April 28, 2009

The Latest on Mortimer

I'd been wondering lately what Mortimer was up to. Since being laid off at the end of February, he'd only managed to go on one interview. I tried to hook him up with a job at my company that would have been perfect, but the position ended up being down-graded and they thought he was overqualified and didn't even interview him beyond an introductory phone call with an HR person. In our last couple of emails, he was being a little evasive about whether he had any more job leads and I was starting to worry that he was in total denial about his situation.

But we had dinner last night, and the good news is that he's been working for about a week! The bad news is that it's a temporary project... and he's being paid under the table. This is totally dicey, of course. He's still collecting unemployment, but the weekly payment is particularly low in New York, so this extra money really helps. He just had to renew his lease, which meant his rent went up by about $100, to $1,250, I think. His health insurance is about $250 a month-- weirdly, it's now less than it cost him when he was employed, thanks to the COBRA changes that were part of the stimulus package.

It's interesting to see these government policies at work in a way that directly affects someone I'm close to-- sometimes it's too easy to see government spending as this big waste that just goes straight into the hands of corrupt administrators or the stereotypical welfare cheat who's sitting around watching TV while the checks roll in. On the one hand, what Mortimer's doing isn't exactly ethical-- he's definitely gaming the system. But on the other hand, he wants to work and has been trying to find a job. He found a situation where someone could afford to pay him for a little while, but knowing the future of it was uncertain, they wanted him to be able to keep collecting unemployment benefits (I think he is getting even less than the maximum of $430 per week). If Mortimer gets the chance to take a real full-time job, he'll happily do it, so I can't really blame him for what he's doing to make ends meet in the meantime. (FYI, of the 30 other people who were laid off with Mortimer, he said only 6 have found jobs.)

Have you ever been paid under the table? Would you do what Mortimer's doing?

Posted at 9:54 AM 12 comments

Labels:

career,

crisis,

friends,

government

![]()

Monday, April 27, 2009

What's a Necessity?

Here's something very interesting from Floyd Norris's blog on the NY Times website:

What’s a Necessity?

In 2006, 70 percent deemed [air conditioning] a necessity. This year the figure was down to 54 percent. Dishwashers, clothes dryers, microwave ovens and television sets are also seen as necessities by fewer people now than in 2006.

Overall, 52 percent think a television is a necessity. That is the lowest figure since that question was first asked in 1973.

The television breakdown is interesting. The older you are, the more likely you are to view it as a necessity. Among those over 65, 68 percent think a set is a necessity, compared to 38 percent of those age 18 to 29. But both those figures are down from three years ago.

Similarly, the young are more likely to view a cellphone as a necessity, and less likely to see a need for a landline.

Fascinating! I'm sure some of this must be a psychological adjustment to being faced with the possibility of not being able to afford something you used to think was necessary-- it's easier to accept if you can brush it off as something you didn't really need anyway! The data is from the Pew Research Center, where there is a nice chart that shows the sudden decline in necessary-ness of quite a few items!

Posted at 9:00 AM 12 comments

Labels:

living within one's means,

news,

spending,

statistics

![]()

Friday, April 24, 2009

A Couple Tidbits of Recent News

Gotta love this headline: Ford Has Loss of $1.4 Billion in Quarter, but Beats Forecast. How bad must that forecast have been??

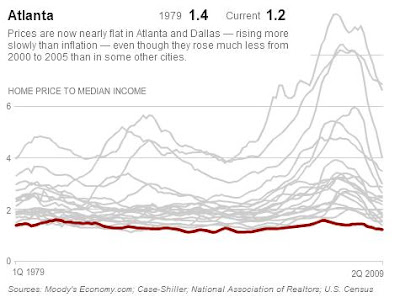

In other economic news, I really liked the charts of median housing prices vs. income in various cities that accompanied an article in the NY Times a few days ago. If you look at it this way, quite a few cities never really had a housing bubble at all-- there was just the kind of price increase you'd expect as incomes grew. Example, Atlanta:

Then there are cities that had extremely pronounced skews in housing cost as a percentage of income. San Francisco and New York have always been expensive, and are still priced higher than historical averages:

It's interesting to note that in 1979, New York was actually a more affordable place to live than San Francisco in these terms:

Los Angeles had one of the biggest spikes of all, but prices have fallen steeply in relation to income:

What I'd really like to see is a breakout of the two factors in each of these graphs-- the actual median home prices over time and the actual median incomes over time. I think part of the story here is that median incomes are pretty flat, as most people have gotten pretty much no benefit at all from the economic growth we've had over the past decade. In cities with the highest degrees of income inequality, like New York, we see the biggest housing bubbles, as those at the highest end of the income spectrum, who have increased their wealth the most in both absolute and relative terms, help drive up prices for everyone else. That's my theory anyway... either way, I do love data and charts like this. I should have become an economist!

Posted at 10:28 AM 0 comments

Labels:

economy,

news,

real estate

![]()

Thursday, April 23, 2009

The "Making Work Pay" Tax Credit

I noticed the change on my last paycheck-- my Federal tax withholding had decreased by about $22. (I'm paid twice a month.) I wasn't sure if I'd qualify for this tax credit (see my post about the stimulus payment last year) so this was pleasant news.

If you want more information about this tax credit, here's an article at Kiplinger's which arrived in my mailbox just in time to remind me what the name of the program actually was! Is it just me, or does it seem like this has been kind of under-played in the news?

Posted at 9:00 AM 10 comments

Labels:

economy,

government,

taxes

![]()

Wednesday, April 22, 2009

A Visit from Family

Pardon my hiatus-- I was entertaining my sister and her family for a couple of days. It's funny that the last post was about small, cool apartments-- there's nothing like having two toddlers and their parents visit to make you think that there is nothing cool at all about having a small apartment!

Other interesting lessons from this visit:

The value of a $500 stroller is questionable, but it's especially useless for touring around Manhattan. The double-wide monstrosity my sister's in-laws gave them is almost as big as one of those Smart cars, and much harder to park. If you're going to be riding around on the subway, or want to actually enter any buildings, a cheap, lightweight folding stroller is a much better option.

And which would you think would be more expensive, a Polish coffee shop in Brooklyn Heights or a highly popular Italian restaurant in Times Square? Oddly, the bill was almost the same at both places, about $110-120 for 4 adults and 2 children, including tip. Carmine's in Times Square seems expensive when you first look at the menu, but the family-style servings are so huge, it becomes an very good value, especially if you take home the leftovers, which were enough for another dinner for two, plus a small lunch for one.

All in all, the visit was great fun. I loved seeing how my niece and nephew reacted to their first subway ride, their first skyscrapers, seeing the Statue of Liberty from a rooftop, and visiting my office (which they did with just me, while their parents waited on the sidewalk outside with the too-large stroller). Although I was glad to get my apartment back, I was sorry to see them leave.

But then, an hour after they departed for the next phase of their vacation (3 days in Washington, DC, where the kids thought they'd be sleeping at the White House and petting the Obamas' new dog), my mother called to see how things had gone. She then launched into a whole tirade about not understanding why they were spending money on this trip when they had so much debt. I suppose their justification was that the hotel in DC was "only $150 a night" and all the museums there were free.

My mother also dropped a bit of a bombshell: something may have been lost in translation, but apparently my sister told her she was unhappy that she couldn't get her kids into a particular school system (she's sort of on the line between two towns) and that they might have to move back to my parents' home town for the schools there, and that my mother shouldn't go too far with all the household projects she's trying to tackle, because they might want things done differently if they end up taking over that house!

I'm really trying to give my sister the benefit of the doubt here, as she and my mother can have very conflicting versions of their arguments. But I certainly hope she's not just waiting for my dad to die or be put into a nursing home so she can kick my mother out of the house and just take it over for herself! If that is her emergency fallback get-out-of-debt plan, it's... it's... I don't know, just F***D UP!!!

You can see why there are so many family dramas relating to inheritances, etc. It just brings out the worst in everyone involved!

Posted at 1:28 PM 13 comments

Labels:

family

![]()

Friday, April 17, 2009

Small is Cool at Apartment Therapy

It's that time again... Apartment Therapy's annual Small Cool Apartment contest. Living in less space can be a great way to spend less money, and the apartments showcased in this contest are always inspiring! Though there may be a few design touches that aren't cheap, Apartment Therapy usually has a lower-budget aesthetic than other home design resources, so it's been a web fave of mine for years.

I currently live in under 700 square feet. My previous apartment was about 240 square feet. Neither place would win this contest, but I have always felt that I had a neat, cheerful and cute apartment that I was happy to come home to.

How big is your living space? How much do you pay for it monthly? Tell us where you live so all the New Yorkers won't start having heart attacks!

Posted at 8:16 AM 52 comments

Labels:

household,

links,

real estate

![]()

Thursday, April 16, 2009

A Sad Tale, with Violins (Really)

Read this article, from the New York Times: At an Age for Music and Dreams, Real Life Intrudes

Her name is Tiffany Clay and she is 18, with light brown hair tied in a ponytail and large eyes that always seem at the edge of tears. She has been on her own, more or less, since she was 16, and the violin in her delicate hands was bought for $175 on eBay by her music teacher.

She is a complicated young woman, says that teacher, and a gifted musician. Consistently at or near the very top of her class. Should be going to a top college, on scholarship. Should be, but won’t be, because she feels a need to make money more than music.

Ms. Clay is a child of her age and place, worried about being laid off, uninterested in and maybe even afraid of imagining a life beyond central Ohio. Newark is what she knows: a pleasant, bifurcated city of 45,000, where concerns about unemployment temper the pride in local public art, and where affluence and poverty sit side-by-side in the classroom.

She once explored the idea of going away to college to become a music teacher. But it just didn’t seem practical: spending four years studying the theory of music, which doesn’t interest her, while here in Newark, the school system is constantly adapting to real and threatened cuts.

Music programs always seem among the first to go, she says. No job security in Tchaikovsky.

So she is maintaining high grades, playing in the orchestra, working 35 hours a week as a Sonic Drive-In carhop, paying $345 a month for the small apartment she shares with an unemployed boyfriend — and planning to study nursing for two years at a technical college in Newark.

“Everybody gets sick,” she says, plotting her future.

Many people will read this and think this girl has had to grow up way too fast. It's a shame her family has fallen apart and can't support her, and that she has a talent she can't pursue further. She's missed out on truly having a childhood, that wonderful time that should be full of dreams and hope, and free of the pressures and responsibilities that come with being an adult.

But others will think it's the story of a tough, resourceful kid who is doing exactly the right thing, and that more young people should be just like her. She's not all starry-eyed about becoming a violinist, a profession where there's probably a-million-to-one odds of being able to make a living. She's not some spoiled kid whose parents will be supporting her for a decade because she's chasing a dream that doesn't pay. She has taken a cold, hard, realistic look at her life and is doing what someone in her situation needs to do to get by, without any pretension that she's "better than that," or that following a calling to make music full-time is somehow her only destiny.

The comments on the article touch on both sides of the argument, and bring up some very interesting points. I find myself somewhat torn between the two views described above. Either way, I think everyone can agree that Tiffany Clay is a very impressive young woman, no matter what she decides to do next.

What do you think?

Posted at 8:17 AM 13 comments

Labels:

career,

decisions,

education,

family,

living within one's means,

self-image

![]()

Wednesday, April 15, 2009

A Vision of the Future

I really enjoyed this post at Accidental Mysteries: Science Writer in 1950 Predicts the Year 2000. A 1950 article from Popular Mechanics is annotated with whether or not the predictions were accurate. A few of them were rather prescient, such as

This expansion of the frozen-food industry and the changing gastronomic habits of the nation have made it necessary to install in every home the electronic industrial stove which came out of World War II. Yes (the microwave).

But some are a bit far-fetched:

• Tottenville is illuminated by electric “suns” suspended from arms on steel towers 200 feet high. NOT!

• The Dobsons use the family helicopter, which is kept on the roof. NOT!

• Discarded paper table “linen” and rayon underwear are bought by chemical factories to be converted into candy. NOT!! NOT!! NOT!!

And of course I found a few things that touch on the original writer's idea of the economy of the 21st century:

• By 2000, wood, brick and stone are ruled out because they are too expensive. NOT!

• Houses are cheap. NOT!

• With all its furnishings, Joe Dobson paid only $5000 for [his house]. Though it is galeproof and weatherproof, it is built to last only about 25 years. NOT!

• Two-dozen soluble plastic plates cost a dollar. They dissolve at about 250 degrees Fahrenheit, so that boiling-hot soup and stews can be served in them without inviting a catastrophe. The plastics are derived from such inexpensive raw materials as cottonseed hulls, oat hulls, Jerusalem artichokes, fruit pits, soybeans, bagasse, straw and wood pulp. Not, but I like the idea. Not plastic plates, but environmentally friendly plates made of natural stuff.

• Corporation presidents, bankers, ambassadors and rich people in a hurry use the 1000-mile-an-hour rocket planes and think nothing of paying a fare of $5000 between Chicago and Paris. Yes, in the year 2000 a ticket on the Concorde cost over $8,000.

• It takes no more than a minute to transmit and receive in facsimile a five-page letter on paper of the usual business size. Cost? Five cents. Yes.

Be sure to click through and look at the original article and its illustrations-- the hose-down housecleaning of the future is hilarious!

Tuesday, April 14, 2009

I'm the Next Contestant on The Price is Right!

Not really, though I'd get a kick out of meeting Drew Carey! But I was thinking about this today: how good a sense do you have of what things cost? And I mean the little things in life, that you might buy occasionally if not every day.

Example: dental floss. I just saw my favorite kind at Duane Reade. (Glide Comfort Plus Mint) They don't always have it in stock, so I grabbed 3 packs. Then I noticed that it was $4.99 each. That seemed weird to me-- I have no idea how much I've paid in the past, but if you'd asked me how much a pack of dental floss cost, I'd have guessed maybe $2.99. I haven't bought it in a few months, but I've bought it many times, and always at Duane Reade, so why was my guess off by 40%???

In trying to think of other things like this, I'm sure there are many household items for which I have no idea how much I'd pay-- cleaning products, sponges, a pound of sugar. And for bigger things like a lawnmower or a car or a set of skis, I'd be totally clueless. If I was a contestant on The Price is Right, I'd probably lose! How would you do?

Posted at 9:00 AM 6 comments

Labels:

price comparison,

shopping

![]()

Monday, April 13, 2009

I Wish They'd Pay Me Not to Work!

I'm sure this article will inspire much jealousy:

$80,000 for a Year Off? She’ll Take It!

The law firm Skadden, Arps, Slate, Meagher & Flom has offered all its associates the option of accepting 1/3 of their base pay to not work for a year. They're encouraging the associates to do pro-bono work and trying to help them find projects, but there are no strings attached-- the lawyers who take this deal can sit around twiddling their thumbs for a year if they are so inclined.

Would I take $80,000 for a year off? Hell yeah! But $80,000 is a lot more than 1/3 of my salary. At 1/3 of MY salary, which would be $31,000, I'd have to dip into savings or take a part time job in order to feel comfortable about making ends meet. Suddenly the big neon sign blinking "FUN" isn't looking quite so bright!

I would imagine that many of these lawyers face a similar dilemma-- $80,000 is a lot of money, but if you've built your life around a $240,000 salary plus a bonus, and if you're still repaying law school loans, you might not be prepared to make the necessary adjustments to your lifestyle. I'd like to think that if I had become a lawyer, I would be one of the few smart ones who lived simply, repaid her debts and saved a lot of money, instead of splurging on luxuries... but I'm not sure I would have been able to do it! Peer pressure is a powerful thing-- whether or not your peers are actually pressuring you or judging you, it's hard not to want to enjoy a similar lifestyle to those around you.

In any case, I doubt I'll have to worry about making this sort of decision. These offers don't happen in in my profession very often. I remember when Random House offered its employees some sort of sabbatical program, but I don't think you were paid if you took time off-- keeping one's benefits and being able to return to one's job were considered good enough, I guess!

Would you take a year off if given the opportunity? How much money would you be willing to give up?

Posted at 8:38 AM 18 comments

Labels:

career,

income,

living within one's means,

salary

![]()

Friday, April 10, 2009

March 09 Recap

I love the month of March. It's bonus time, it's usually tax refund time, and this year, it was even a stock market rally time! My net worth is up by 10.5%, to as much as $312,721. (Again, I perhaps should express this as a range of maybe $300-312k due to the current real estate market, though I have my reasons for thinking the higher end of my range is still not too far fetched-- this is based on specific info in my area and my price range, not overall averages for Brooklyn or NYC. But it is definitely a fuzzy area right now, so I'll keep this open-ended until I have more info on which to base a change.) You can see the details at NetworthIQ.

As for income and expenses:

In addition to my salary, I got a bonus which came to a little over $5,000 after taxes and 401k deductions. A lot less than last year, but hey, it's something! I also got my Federal tax refund of $2,995, so the inflows were much higher than usual this month.

For expenses, this month I'll do the detailed dump from Quicken.

| Business expense | -$32.19 | (reimbursement) |

| Clothing | $67.37 | |

| Education | $41.00 | |

| Books | $55.23 | |

| Movies | $5.41 | |

| Entertainment - Other | -$20.00 | (paid back for something) |

| Internet Access | $29.95 | |

| Newspapers | $42.40 | |

| Gifts Given | $1.07 | (a card) |

| Personal care | $104.00 | |

| Misc - Other | $514.84 | (accountant fee & other misc) |

| Laundry | $8.75 | |

| Household - Other | $37.51 | |

| Dental | -$219.44 | (insurance reimbursement) |

| Flex spend | $41.66 | |

| Health Insurance | $74.20 | |

| Commute | $76.00 | |

| Gas & Electric | $104.44 | |

| Telephone | $75.75 | |

| Dining: | ||

| Breakfast | $21.78 | |

| Dinner | $273.77 | |

| Groceries | $178.80 | |

| Lunch | $116.80 | |

| Liquor | $0.00 | (Wow!) |

| Taxes: | ||

| Federal | $3,347.38 | |

| Medicare | $284.33 | |

| NYC tax | $593.67 | |

| SDI | $2.60 | |

| Soc Sec | $1,215.74 | |

| State | $1,063.20 | |

| Housing | $2,074.17 | |

| TOTAL | $10,180.19 |

I should also note that I contributed $3,560.78 to my 401k this month from salary and bonus deductions.

Next month it will be back to the dreary reality of just getting my salary, plus a smaller state tax refund that just hit in April. But hopefully I will continue to keep my spending in line, and fingers crossed that the markets cooperate to push my net worth upward... and onward!

Posted at 9:00 AM 6 comments

Labels:

expenses,

income,

monthly recap,

net worth,

saving

![]()

Thursday, April 09, 2009

Are You Anxious About the Recession?

A lot of people out there are feeling pretty stressed out about the economy these days: Recession Anxiety Seeps Into Everyday Lives, from today's New York Times:

Anne Hubbard has not lost her job, house or savings, and she and her husband have always been conservative with money.

But a few months ago, Ms. Hubbard, a graphic designer in Cambridge, Mass., began having panic attacks over the economy, struggling to breathe and seeing vivid visions of “losing everything,” she said.

She “could not stop reading every single economic report,” was so “sick to my stomach I lost 12 pounds” and “was unable to function,” said Ms. Hubbard, 52, who began, for the first time, taking psychiatric medication and getting therapy.

That might seem pretty extreme, but the article goes on to detail various other cases of people having nervous breakdowns and turning to drugs, therapy, meditation and other methods to reduce their levels of stress about the economy, despite still being employed and having savings.

Ms. Hubbard, knowing “financially we were fine,” said she believed “I shouldn’t feel like this, I’m lucky.” She cried visiting her primary doctor, who recommended therapy and medication, hard to accept, she said, because her Depression-era parents believed “you pull yourself up.”

“I felt like a neurotic middle-class, middle-aged woman too weak to deal with life on my own,” she said. “I should be stronger, it was simply money, and why do I have to take pills to not worry about money.”

But treatment and further organizing family finances helped. She said the weakening economy made her “fear that even if you do everything right, something bad can happen to you.”

Do you feel this way, or know anyone who does? I find myself worrying about money in a way that I didn't a couple of years ago. Back then, I knew I was saving money at a good rate, and my investments were doing well enough that I seemed to be right on track to reach my retirement goals. Hopefully I'll still end up fine, but I may not be able to have quite as much fun along the way!

Meanwhile, I'm worried about my friend Mortimer, who's only had one interview since losing his job. I recommended him for a job at my company, for which he would have been very qualified, and they did call him to discuss it, but it turned out that the position paid about $25,000 less than he'd been making. Mortimer, to his credit, made a very good case about why he'd still be interested, but they seem to fear he's overqualified, or would be likely to move on at the first opportunity. To me, Mortimer admitted he wasn't thrilled about the idea of making so much less, but he was already trying to figure out how he could make ends meet on a lower income, knowing that he has to get a job, any job. But there aren't many out there in his field, unfortunately, and I know he doesn't have a lot of savings to fall back on. I haven't heard whether he's been able to start collecting unemployment benefits yet, and I'm worried he'll get into debt very quickly.

Fortunately, my worries are mild at this point. I'm not losing sleep or pulling out my hair, though I've probably been more stressed out at work because we're all under a lot of pressure to perform. But I'm trying to take it all in stride and save any real anxiety for an actual crisis, which hopefully won't happen!

How about you?

Posted at 9:17 AM 8 comments

Labels:

crisis,

economy,

friends,

living within one's means,

saving

![]()

Tuesday, April 07, 2009

Snicker Shock

I had a little candy attack yesterday when I bought my lunch at the deli. Most times, I am able to resist these temptations, but lately I've been building up a real craving! And maybe PMS tipped me over the edge or something, I don't know...

That is a lot more then a Snickers would have cost-- maybe 4 times as much? The Ritter bar was maybe only 50% more in weight or volume. And it didn't end up being 50% more yummy-- I thought it would just be chocolate and cookie, but there turned out to be a cocoa cream in there too that made it feel a bit gloppy in the mouth.

Oh well-- I won't be spending that $4 ever again...

Posted at 9:02 AM 15 comments

Labels:

food

![]()

Monday, April 06, 2009

Investing in Bear Funds

I was doing some research on mutual funds this weekend. I've been wanting to change some of my Roth IRA investments because they seemed to be underperforming even the sucky market averages in the last few months, and hadn't been doing well even before things tanked. Then, to complicate matters even more, E*Trade decided to shut down a couple of funds I was invested in, forcing me to have to sell and reinvest that money.

I ended up buying VBINX, (a blended stock/bond index fund with a low expense ratio) but while using all the fund screening tools on E*Trade, I was fascinated to see what the best performers have been over the past year:

RYCWX: "The investment seeks to provide investment results that will match 200% inverse of the performance of the Dow Jones Industrial Average. The fund invests at least 80% of assets in financial instruments with economic characteristics that should perform opposite to those of the underlying index. It is a nondiversified fund and enhanced index fund."

RYTPX: "The investment seeks investment results that correlate to 200% inverse of the S&P 500 index. The fund invests all assets in financial instruments with economic characteristics that should perform opposite to the securities of companies included in the underlying index. It is a nondiversified enhanced index fund."

URPIX: "The investment seeks daily investment result that corresponds to twice the inverse of the daily performance of the S&P 500 index. The fund takes positions in financial instruments that should have similar daily return characteristics as twice the inverse of the S&P 500 index. It employs leveraged investment techniques in seeking its investment objective. The fund invests assets which are not invested in equity securities or financial instruments in debt instruments or money market instruments. It is nondiversified."

All of these are up by more than 90% over the past year, which is not surprising for anything that's supposed to do the opposite of what the Dow does.

Over the past few months, I've often wished I was one of the people who could somehow make money from this disaster-- by short selling stocks, for instance. But that kind of transaction is a bit complicated and risky for someone like me. Mutual funds are much simpler, so it's tempting to buy one of these funds-- but again, for someone like me, I'm not sure it's a good idea. If I'd foreseen the market we've had over the last few months, owning a fund like these would have been a great hedge. Even over the past 5 years, they're all up right now, from 5-8%. But if the market continues to rally, they'll eventually be down. And remember, these are the top 3 performers-- I'm sure many other funds like this haven't done as well over the long term.

The key word in the previous paragraph is "foreseen." The other key thing is timing. No investor anywhere can see into the future, and even among the best economic minds in the country, last fall's stock market crash was not universally anticipated. So should a total amateur like me think she can predict this stuff? And even for people who saw a credit crunch coming, it had to take a lot of nerve, I think, to bet your money on the market tanking. To make the most of a fund like this, you'd have to know when to get in and when to get out-- remember that these funds track the inverse of the Dow times two, so if the market starts going up, you're down by twice as much. Conventional wisdom has always been that the average individual investor just shouldn't mess around with trying to time the market, but instead focus on long-term gains.

Of course, a lot of conventional wisdom seems to have gone out the window lately, so who knows. I'll keep this kind of investment in the back of my mind in case it ever seems like something worth trying. But I'm not sure I'll be able to recognize that moment when it comes. I wouldn't describe myself as a Pollyanna-ish optimist in general, but I think I and many Americans share a desire to see things positively, to see downturns as just small bumps in an otherwise easy road. On the whole, this probably isn't a bad attitude to have, as long as you aren't totally ignoring reality (although ignoring reality was exactly what a lot of people did over the last couple of years.) I think this sense of optimism makes it hard for people to do something that feels like investing in failure.

Here's an article from Kiplinger's about bear funds, for another perspective. What do you think? Would you invest in a bear market fund?

Posted at 10:30 AM 5 comments

Sunday, April 05, 2009

From the Mailbox

A few recent items:

New blogs you might want to check out:

Hot Money Mess (love the title!)

Aspiration's Purse

Self Magazine launches a new blog by MP Dunleavy, called Save Like Me.

A NYC therapist who specializes in "money disorders" is offering a workshop.

The FTC has a new site: FTC.gov/MoneyMatters

Money Matters offers short, practical tips and links to reliable resources for more information on topics like credit repair, debt collection, job-hunting and job scams, vehicle repossession, managing mortgage payments, and foreclosure rescue scams. Site users also can learn how to recognize and avoid consumer scams and rip-offs.

Here's a list of the $51 worth of coupons available in the April issue of All You magazine, sold in WalMart.

Posted at 12:08 PM 5 comments

Friday, April 03, 2009

The Economics of a Starter Garden

This looks like it will be a fun series on the NY Times website: The Starter Garden: A Novice in Search of Bounty.

...I resolved to plant a brand new vegetable garden. The plan is to transform my family’s diet, save a few coins, make over the property — and, maybe, receive a congratulatory note from Michael Pollan for my new green virtue. To keep sentimentality at bay — I’m thinking of all those paeans to the sensual pleasures of loam — I intend to unloose my inner bean counter. This means keeping a strict account of how much money and time I bury in the garden, and the cash value of the produce I pull out (at Whole Foods prices).

I am itching to get a garden going myself. For the last couple of months, I've been attempting to start some herbs using a Chia Herb Garden that I bought on a 50% off sale at Rite Aid. One of the pots was a non-starter, and I managed to kill two others, but I'm left with a pot of parsley that seems to be off to a healthy start.

The question is, what next? The summer before last, I had a nice tomato plant on my balcony. Last summer, my garden more or less died when I went off on my 2-week vacation without enough watering arranged. This year, I'm itching to have lots of flowers and vegetables, though I don't want to go overboard planting things that won't survive. And I'm also trying to figure out where I'll put them, as Sweetie has a bit of a yard where we could plant a few things. Does anyone have recommendations for good plants for a very hot, sunny balcony, and a kind of rocky, shady yard?

Posted at 9:12 AM 12 comments

Thursday, April 02, 2009

Voluntary Pricing at Museums

After my post the other day about flexible pricing for hair cuts, I was thinking about other situations where how much one pays may be somewhat self-determined. Museums are a prime example. I went to the Philadelphia Museum of Art not long ago, on a Sunday when they offer "pay as you wish" entry pricing. The normal price is $14, so I just paid $14. The Metropolitan Museum in New York offers "suggested" rates all the time. It's $20, which starts to feel a little steep, but even $20, to me, doesn't feel like something I should be trying to skimp out on. I've spent $20 on far stupider things than a great art museum. I can afford $20, and I'm happy to support the museum being able to offer discounted rates to other people for whom $20 would be prohibitive. But if the entry fee was $50, or $100, I'm sure I'd be more likely to opt out of paying full price!

How do you decide whether you can pay full price when it's optional? If a museum offers flexible pricing, should you pay less just because it's the frugal thing to do?

Posted at 9:20 AM 17 comments

Labels:

art,

decisions,

entertainment,

spending

![]()

Wednesday, April 01, 2009

I Won the Lottery!

I can't believe I'm writing this, but I actually hit a pretty big jackpot in the New York Lotto! The only problem was that the way I accomplished this was to buy a ticket for every possible number combination that could have been drawn. I haven't actually done the math yet, but I don't think I'll come out ahead... oh well!

Posted at 4:00 PM 10 comments

Labels:

fun

![]()